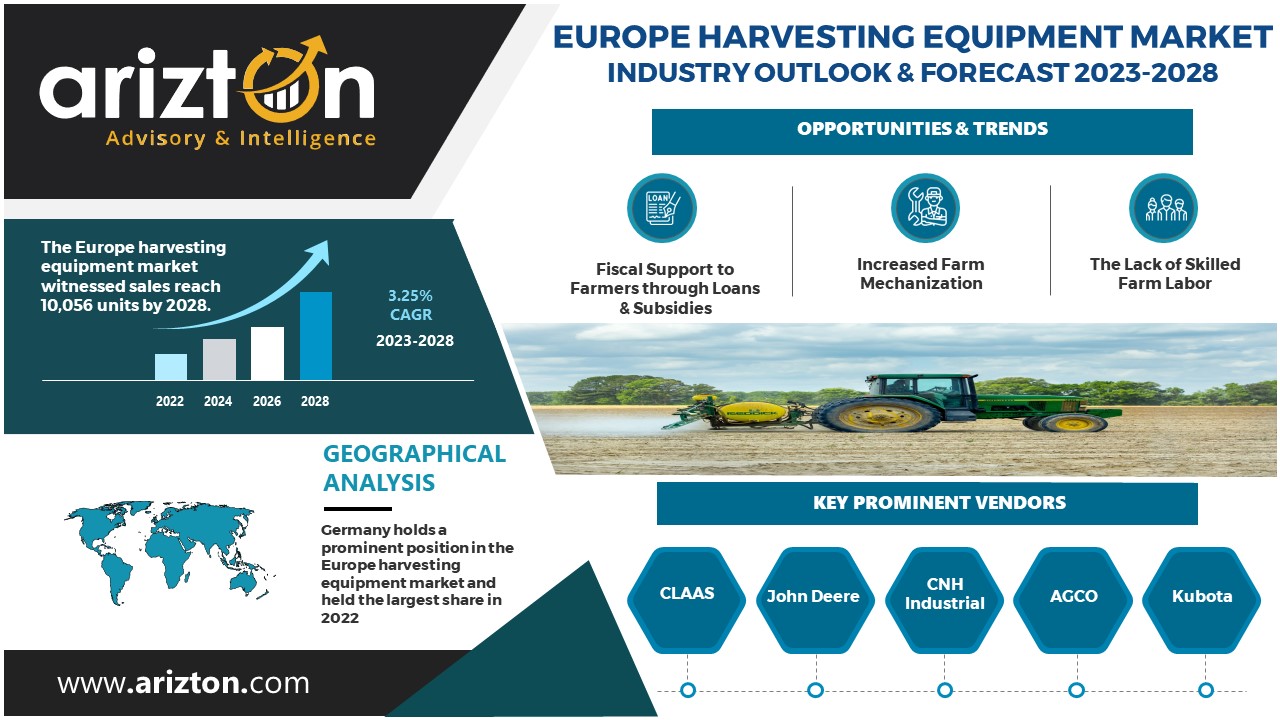

Arizton publishes the latest research report on the Europe harvesting equipment market – industry outlook & forecast 2023-2028. The market is growing at a CAGR of 3.25% during 2022-2028.

The report examines the current state of the European harvesting equipment market and its dynamics from 2023 to 2028. It comprehensively overviews various factors driving market growth, constraints, and emerging trends. The study encompasses both the demand and supply aspects of the industry. Furthermore, it includes profiles and analyses of leading companies and several other prominent firms operating within this sector.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3962

The primary driving force behind the growth of the European harvesting machinery market is the heightened need for more efficient agricultural practices, leading to an increased demand for advanced harvesting equipment. Furthermore, the market’s expansion is fueled by the growing pressure on arable lands caused by the rising global demand for food grains. Notably, technological innovations within this sector, including integrating global positioning sensors and cameras, have facilitated the development of automated multitasking machinery, consequently bolstering its demand. Despite these positive factors, the market faces a significant constraint in the form of elevated capital investment requirements and substantial power consumption associated with harvesting machinery.

Recent Developments in the Europe Harvesting Equipment Market

- In March 2023, John Deere announced MY24 updates for its 7, 8, and 9 Series Tractors lineup that will help prepare them for the future of precision agriculture.

- AGCO launched the latest Fendt 700 Vario series tractors in August 2022, featuring an upgraded powertrain with VarioDrive transmission and Fendt iD low engine speed concept. This new generation aims to enhance efficiency and productivity for customers.

- In June 2022, the CLAAS AXION 900 series of large tractors for contractors and big farms the new AXION 900 series are equipped as standard with the updated, continuously variable ZF Terramatic transmission.

- John Deere launched the new electric variable transmission (EVT) for select 8 Series Tractors and a new JD14X engine for 9 Series in March 2022.

- Massey Ferguson launched the MF 6S series tractors in February 2022. This machine provides up to 180 HP with advanced technology.

Buy this Report @ https://www.arizton.com/market-reports/europe-harvesting-equipment-market

Why Should You Buy this Report?

This report is among the few in the market that offer outlook and opportunity analyses forecast in terms of:

- Market Size & Forecast Volume 2020–2028 (Units)

- Segmentation by Harvester Type

- Segmentation by Geography

- Major current and upcoming projects and investments

- Competitive intelligence about the economic scenario, advantages, and benefits of harvesters, industry dynamics, and industry shares

- Latest and innovative technologies

- Import and export analysis

- Company profiles of major and other prominent vendors

Combine Harvesting Equipment to Hold the Largest Share in the Market

The Europe combine harvester market to reach 8,156 units in 2028. The combine harvester segment generated the highest sales in almost all countries. Stakeholders in food production, including public and private bodies and farmers, focus on closing the yield gap and increasing substantial increments due to the global challenge of food shortage. Harvesters will play a pivotal role in operating all new-age technologically advanced equipment to fulfill the need for increased output from farms.

Combines have revolutionized the harvesting process, allowing farmers to efficiently and effectively collect large quantities of crops. They continue to evolve with advances in technology, automation, and data management, contributing to the improvement of agricultural practices and overall productivity.

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

Key Company Profiles

- CLAAS

- John Deere

- CNH Industrial

- AGCO

- Kubota

- Grimme

- SDF

- Krone

- KUHN Group

- Yanmar

Market Segmentation

Harvester Type

- Combine

- Forage

Geography

- Germany

- France

- The UK

- Poland

- Spain

- Others

Key Questions Answered in the Report:

What are the expected units sold in the Europe harvesting equipment market by 2028?

What is the growth rate of the Europe harvesting equipment market?

How big is the European harvesting equipment market?

Which region holds the largest Europe harvesting equipment market share?

Who are the key companies in the Europe harvesting equipment market?

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/europe-harvesting-equipment-market