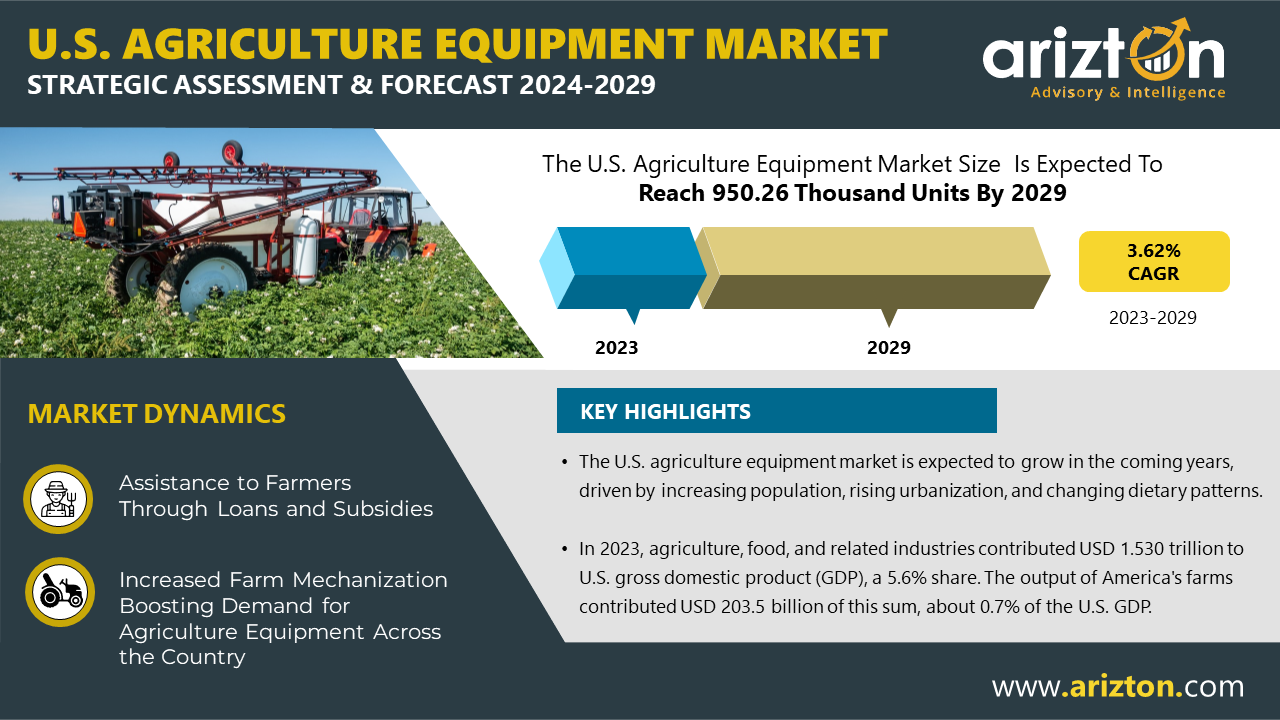

According to Arizton’s latest research report, the US agriculture equipment market is growing at a CAGR of 3.62% during 2023-2029.

Curious to Know More About the Market? Click: https://www.arizton.com/market-reports/us-agricultural-equipment-market

The US Agricultural Equipment Market Report Scope

Market Size (2029): 950.26 Thousand Units

Market Size (2023): 767.88 Thousand Units

CAGR (2023-2029): 3.62%

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Market Segmentation: Seedling & Planting, Agriculture Tractors, Land Preparation, Plant Protection, Harvesting, Other Equipment

Stay ahead of the curve with Arizton’s exclusive subscription plan, offering in-depth analysis, market sizing, and growth forecasts for less than $900 per month—a significant value compared to individual report purchases. Click here: https://www.arizton.com/subscription

Key Highlights:

-

Elon Musk’s SpaceX has partnered with John Deere to integrate Starlink technology into farm equipment, enhancing connectivity for rural farmers. This collaboration aims to improve access to precision agriculture tools, enabling more efficient farming operations and better resource management.

-

In 2024, AGCO introduced the new 30-foot Momentum planter from its Fendt brand, designed for medium-sized to small farms up to around 1,000 acres. Key features include a Vertical Contouring Toolbar following field topography, SmartFrame technology to position each row unit, and carrying 100 bushels of seed and 800 gallons of liquid fertilizer.

-

In March 2024, Case IH launched AFS Connect Steiger Series Tractors, these high-horsepower tractors come equipped with advanced telemetry and data management features for improved farm management.

-

In January 2024, StrongLike launched the SL-F LEX Hybrid robotic fruit harvester that uses AI to pick apples, thus reducing damage and labor costs gently.

-

John Deere launched a precision upgrade program in 2023 in the US that allows farmers to retrofit existing equipment with the company’s latest precision farming technologies instead of having to purchase all-new machinery.

Market Trends

Farm mechanization is transforming the US agricultural landscape! In 1990, around 2%-3% of Americans were involved in farming. By 2023, this figure dropped to about 1% and is expected to fall to 0.5% by 2030. This shift underscores the increasing need for advanced farm mechanization.

Despite its agricultural prowess, the US has one of the world’s lowest mechanization rates at approximately 40%, compared to 90-100% in other developed nations and over 70% in China. This low rate, coupled with a reliance on fossil fuel-powered machinery like tractors and diesel engines, is set to drive significant growth in the agricultural equipment market.

Key agricultural states such as California, Iowa, and Nebraska are rapidly adopting new technologies to boost productivity and profitability. The rise in export demand for fruits and flowers has also led to a surge in compact agricultural equipment, with brands like JCB and CLAAS capitalizing on this trend.

Farmers are investing in advanced machinery to replace older equipment, spurring demand for new technologies. Innovations such as data analytics, telematics, remote sensing, GPS, and mobile tech are enhancing precision and efficiency in farming. Features like field mapping, auto-steering, and optimized fuel use, as well as fertilizers and seeds, are becoming standard, while vehicle-to-vehicle control systems further improve fuel efficiency and productivity.

Compact tractors, ideal for soft soil conditions and customization, are gaining traction, supporting ongoing experimentation and development. Together, these advancements promise to revolutionize the US agricultural sector, driving efficiency and productivity through increased mechanization.

Growing Demand for Self-Propelled Harvesters in the US Agricultural Machinery Market

The self-propelled harvester segment is making significant strides in the US agricultural machinery market! In 2023, self-propelled harvesters held a 5.4% share of the overall harvesting equipment market.

These advanced machines are essential for efficiently harvesting crops like soybeans, rice, wheat, and corn, especially in a country with high labor costs. As mechanization in agriculture continues to rise, so does the demand for self-propelled harvesters. The market is fueled by the need to enhance efficiency, government subsidies for farm mechanization, and the growing adoption of modern farming practices.

Looking ahead, technological advancements such as GPS integration and automation are set to propel further growth in the self-propelled harvester market. As farmers increasingly seek to boost productivity and reduce labor costs, this sector is poised for continued expansion.

Why Should You Buy this Report?

This report is among the few in the market that offer outlook and opportunity analyses forecast in terms of the following:

-

Market Size & Forecast Volume (Units) 2020–2029

-

Segmentation by Equipment Type

-

Production and trade values

-

Major current and upcoming projects and investments

-

Competitive intelligence about the economic scenario, advantages, industry dynamics, and industry shares

-

Innovative technologies

-

Share by each equipment segment

-

Company profiles of major and other prominent vendors

-

Company profiles of distributors

-

Market shares of major vendors

US Agriculture Equipment Market Dynamics

Drivers

-

Assistance to Farmers Through Loans and Subsidies

-

Increased Agriculture Productivity and Exports

-

Increased Farm Mechanization Boosting Demand for Agriculture Equipment Across the Country

Trends

-

Rising Focus on Compact & Electric Agriculture Equipment

-

Growing Prospect of Precision Farming

-

Integration of Digital Technologies

Challenges

-

Skilled Labor Shortage

-

High Demand for Rental & Used Agriculture Equipment

Buy this Research @ https://www.arizton.com/market-reports/us-agricultural-equipment-market

Major Vendors

-

John Deere

-

AGCO

-

CNH Industrial

-

Kubota

-

Mahindra

Other Prominent Vendors

-

Yanmar

-

SDF

-

CLAAS

-

KIOTI

-

ISEKI & CO., LTD.

-

LOVOL

-

TAFE

-

Argo Tractors S.p.A.

-

AMAZONEN

-

METALFOR

-

MERLO S.p.A.

-

Bobcat

-

Caterpillar

-

Great Plains Ag

-

Arbos Group

-

BCS S.p.A.

-

LS MTRON LTD.

-

Changfa

-

Wuzheng Group

-

YTO

-

Zoomlion Heavy Industry Science & Technology Co., Ltd.

Market Segmentation by

Equipment Type

Seedling & Planting

-

Planters

-

Seed Drillers

-

Transplanters

Agriculture Tractors

Horsepower Type

-

Less Than 40 HP

-

40-100 HP

-

Above 100 HP

Wheel Drive Type

-

2-Wheel-Drive

-

4-Wheel-Drive

Land Preparation

-

Tillers

-

Plough

-

Harrow

Plant Protection

-

Sprayers

Harvesting

-

Tractor-Mounted

-

Self-Propelled

-

Trailed

Other Equipment

-

Mowers

-

Windrowers

-

Others (Loader and Balers)

Key Questions Answered in the Report:

What are the trends in the U.S. agriculture equipment industry?

How big is the U.S. agriculture equipment market?

What is the growth rate of the U.S. agriculture equipment market?

Check Out Some of the Top Selling Research Reports:

Latin America Agriculture Equipment Market – Strategic Assessment & Forecast 2024-2029

https://www.arizton.com/market-reports/latin-america-agriculture-equipment-market

Southeast Asia Agriculture Equipment Market – Strategic Assessment & Forecast 2024-2029

https://www.arizton.com/market-reports/southeast-asia-agriculture-equipment-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

-

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1-312-235-2040/+1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/us-agricultural-equipment-market