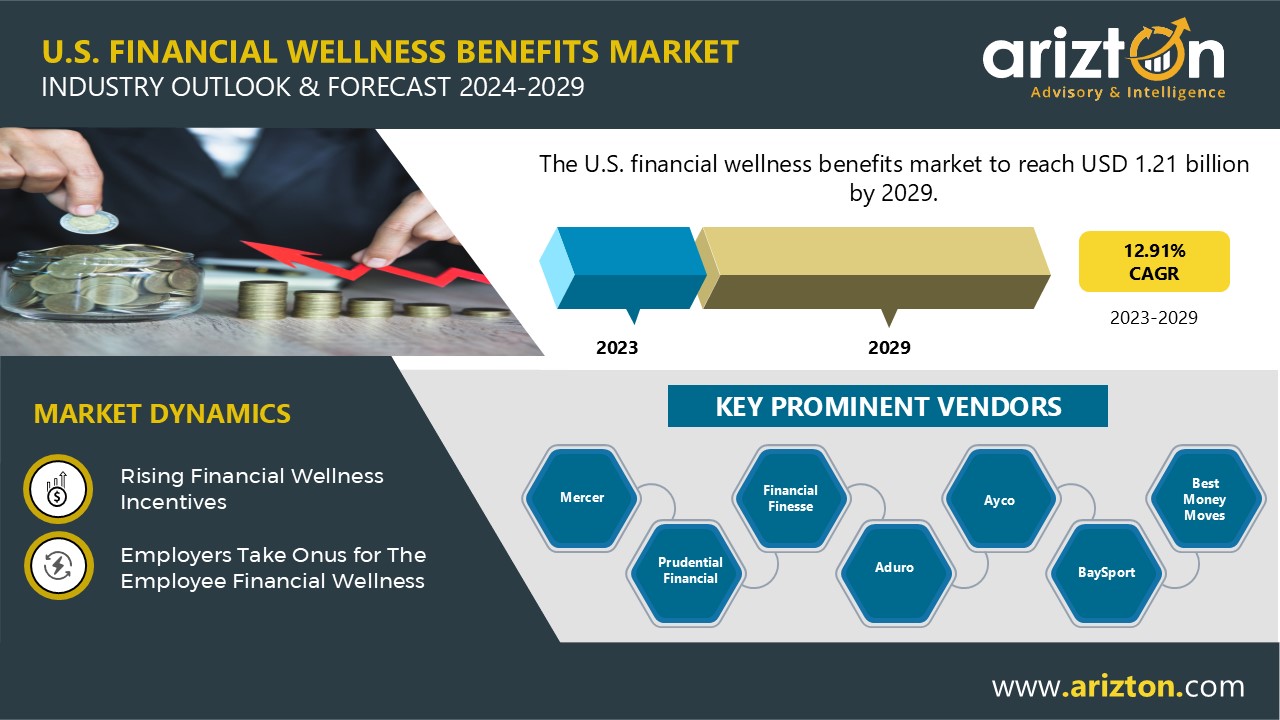

According to Arizton’s latest research report, the US financial wellness benefits market is growing at a CAGR of 12.91% during 2023-2029.

Looking for More Information? Click:

https://www.arizton.com/market-reports/us-financial-wellness-benefits-market

Report Scope:

Market Size (2029): $1.21 Billion

Market Size (2023): $587.02 Million

CAGR (2023-2029): 12.91%

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Market Segmentation: Program, End-User, Delivery, Type, Industry, and Region

Geographical Analysis: United States (South, West, Midwest, and Northeast)

Since 2020, the definition of employee wellness has evolved, with an increasing focus on both mental and physical health, alongside financial well-being. Workers, particularly in the wake of the pandemic, now equate wellness with financial security—freedom from debt, the ability to spend without worry, and sufficient savings for emergencies. This shift has prompted employers to rethink their benefit offerings. While pay raises have been limited due to unpredictable revenues, companies are offering customized financial wellness benefits to retain talent. Programs like debt counseling, emergency savings accounts, caregiving loans, and payroll advances have gained traction, especially for millennials and those nearing retirement.

Around 50% of employers have integrated financial wellness programs alongside retirement plans, with larger employers taking the lead. Employers are also prioritizing short-term financial wellness, addressing healthcare costs and retirement preparedness. In addition, studies show that for every dollar spent on financial wellness benefits, employers save three dollars. This highlights the growing recognition that financial health is essential to overall employee well-being. With a workforce increasingly affected by chronic health conditions and financial stress, companies are proactively designing programs that cater to both long-term health and short-term financial stability. As a result, engagement in these programs is expected to rise, reflecting a changing attitude toward employee benefits.

One-on-One Delivery System to Gain Momentum in the US Financial Wellness Benefits Market

Personalized financial counseling is gaining popularity over digital tools, as advisers can tailor solutions to individual needs, particularly in diverse workforces. Employees increasingly seek one-on-one interactions to navigate their finances, driving growth in the offline market. These sessions, often part of Employee Assistance Programs (EAPs), encourage employees to increase retirement savings and reduce early withdrawals from 401(k) plans. However, managing these sessions in-house can be costly and resource-intensive for HR departments. The U.S. one-on-one financial wellness market is projected to reach to $614.77 million by 2029.

The Southern U.S. Economy: Key Trends and the Rise of Financial Wellness Programs

In 2023, the Southern region of the U.S. held 34.59% of the financial wellness benefits market, driven by major states like Texas, Florida, Virginia, and Georgia. Work, money, and the economy are significant stressors in the South, making financial wellness programs crucial for managing stress and lifestyle changes.

Texas is a key contributor to the region’s economic strength. As of November 2023, the state had an unemployment rate of 4.1%, higher than the national average. However, Texas experienced a robust GDP growth of 7.7% in the third quarter, outpacing the national average. Its GDP stood at $2.5 trillion, representing 9.1% of the U.S. total. Texas’ diverse economy includes thriving sectors like real estate, manufacturing, and agriculture. Despite this, economic growth is expected to moderate in 2024 due to high inflation, interest rates, and a slowing housing market.

The pandemic reshaped the workforce, offering workers more flexibility and opportunities for higher wages, remote jobs, and better work-life balance, presenting challenges for employers in talent acquisition and retention. Although some positive trends have slowed, Texas’ energy sector continues to thrive. Economic growth is expected to pick up in the latter half of 2024 as inflation stabilizes and migration increases.

Large Companies to Generate Largest Revenue

Large companies have long recognized financial anxiety as a serious issue and are increasingly offering comprehensive financial wellness benefits to support their employees. Nearly 40% of employers now provide such programs, often including tools, personalized counseling, and regular check-ins on financial health. Companies with 10,000+ employees tend to offer five or more programs, and the offerings frequently include budgeting, debt management, and stress management training. Leading providers include AYCO, Mercer, Fidelity, and PwC. A growing trend is the integration of financial wellness with physical and mental health programs, recognizing the interdependence of health and wealth.

Although employees often request personalized financial advice, large employers like Eastman Chemical are setting the trend by offering face-to-face, individual financial consultations. Despite the rise in offerings, participation remains low, with 35% of employees unaware of the benefits available to them. Privacy concerns and a lack of time or motivation contribute to low engagement. Nevertheless, large companies are generally more satisfied with their financial wellness programs compared to smaller firms, and digital tools are helping bridge the gap by providing accessible financial education anytime, anywhere.

Competitive Overview

The U.S. financial wellness benefits market is diverse, with over 300 players, including start-ups, employee benefits providers, banks, and non-profits. Start-ups drive innovation, while established institutions partner with smaller players to expand services. Financial wellness programs range from traditional financial products to community-based resources and technology-based services like payroll advances. Although still in its early stages, the market is growing with employer-sponsored programs that combine education, tools, and counseling. However, the quality of offerings varies, with some focusing on niche solutions and others offering generic content. Success depends on personalized, integrated, and engaging programs to enhance employee participation.

Looking for More Information? Click:

https://www.arizton.com/market-reports/us-financial-wellness-benefits-market

Key Company Profiles

- Bank of America Merrill Lynch

- Financial Finesse

- Mercer

- Prudential Financial

- Virgin Pulse (Personify Health)

- Aduro

- Ayco

- BaySport

- Best Money Moves

- BrightDime

- BrightPlan

- Brightside

- Carelon Behavioral Health

- DHS Group

- Edukate

- Enrich

- Even (ONE@Work)

- Financial Fitness Group

- Financial Knowledge

- FinFit

- FlexWage

- Candidly

- GoPlan 101

- HealthCheck360

- Health Advocate

- Integrated Wellness Partners

- LearnLux

- LifeCents

- Limeade

- Mariner Wealth Advisors

- Money Starts Here

- My Secure Advantage

- Origin

- Payactiv

- Pro Financial Health

- Purchasing Power

- Questis

- Ramsey Solutions

- Salary Finance

- Savology

- Sqwire

- SoFi

- The Financial Gym

- Transamerica

- Your Money Line

Program

- Financial Planning

- Financial Education & Counseling

- Retirement Planning

- Debt Management

- Others

End-User

- Large Businesses

- Medium-Sized Businesses

- Small-Sized Businesses

- Segmentation by Delivery

- One-On-One

- Online/Digital

- Group

Type

- Consumer Tools

- Employer Tools

Industry

- Healthcare

- Financial Services

- Education

- Manufacturing

- Public Sector

- Others

Region

- South

- West

- Midwest

- Northeast

The Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the US financial wellness benefits market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/us-financial-wellness-benefits-market

What Key Findings Our Research Analysis Reveals?

How big is the U.S. financial wellness benefits market?

Which region dominates the U.S. financial wellness benefits market?

What are the significant trends in the U.S. financial wellness benefits market?

What is the growth rate of the U.S. financial wellness benefits market?

Who are the key players in the U.S. financial wellness benefits market?

Looking for Customization According to Your Business Requirement? https://www.arizton.com/customize-report/4403

Other Related Reports that Might be of Your Business Requirement

U.S. Corporate Wellness Market – Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/us-corporate-wellness-market-analysis-2024

U.S. IT Staffing Market – Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/united-states-it-staffing-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/us-financial-wellness-benefits-market