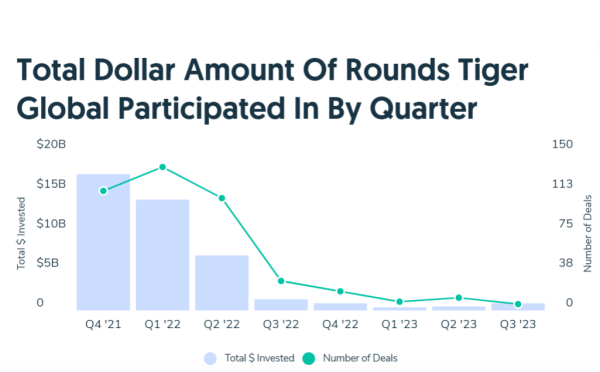

United States – As the venture capital landscape continues to undergo significant shifts, prominent venture funds, including Tiger Global, known for its extensive investment activities in the 2020 and 2021 vintage years, are poised to slash their deal flow by more than 90% from the prolific transactions witnessed in 2022. This development mirrors a broader trend wherein several venture funds are notably pulling back from robust investment strategies prevalent in previous years.

In the preceding year, Tiger Global participated in a staggering 288 transactions, amounting to approximately $23.2 billion in deals, excluding undisclosed or non-publicized investments. However, with only a few weeks left in 2023, there has been a stark decrease in investment activities among leading venture funds. For instance, Tiger Global has publicly announced only one deal in Q4 for an undisclosed sum.

While Tiger Global’s notable involvement in Databricks’ substantial $500 million-plus Series I, led by funds and accounts advised by T. Rowe Price Associates, stands as a testament to its participation in significant rounds this year, the largest round it led was a relatively smaller Series B, approximately $61 million, directed towards Brazil-based fintech startup Nomad.

In stark contrast, Tiger Global’s pivotal role in co-leading a $768 million Series E for London-based on-demand delivery startup Getir last year showcased its robust investment fervor.

Emanuel Martinez, General Managing Partner and Limited Partner for GreenHills Capital Partners©™ and GreenHills Ventures©™ emphasized, “The recalibration of valuations and the imperative to manage capital investments in startup and early-stage companies have reignited interest in deploying capital in stages to manage cash at adequate levels to support the company’s execution plans while positioning for future valuation escalations.”

The market dynamics of late 2022 witnessed a retreat in venture capital as rising interest rates, creeping inflation, and volatile public markets led to a significant pullback, notably in late-stage growth rounds. This shift prompted a reassessment of valuations, causing ripples across the tech startup ecosystem.

“Many venture funds have adjusted their investment strategies in response to these changes,” Emanuel Martinez added, “resulting in reduced target sizes and a preference for undisclosed investments in privately held companies, altering the venture capital landscape significantly.”

Furthermore, there has been a notable surge in portfolio markdowns across various sectors, including AI-powered workflow companies like Superhuman facing a 45% markdown and search engine platform DuckDuckGo experiencing a 72% reduction. Several top-tier venture funds marked down valuations by approximately 33% last year, erasing a staggering $23 billion in value.

“The effect of these markdowns on venture capital availability is palpable,” noted several of the firm’s portfolio companies, indicating a shift towards more financially disciplined investment strategies as seen in tranche investment approaches like that of GreenHills Ventures is widely welcomed.

In the wake of these market shifts, venture funds are reevaluating their strategies to navigate the evolving landscape. Martinez suggested, “A tranche investment approach like the one utilized by GreenHills Ventures©™ may prove atypical in the current and future landscape of venture investing resulting delivering quantifiable increased valuations for achieving milestones.”

For media inquiries, please contact:

Contact Name: Ashley Parot

Company Name: GreenHills Ventures©™

Email Address: aparot@greenhillsventures.com

Company Address: 420 Lexington Avenue, 3rd Floor, Office 300, New York, NY 10017

Phone Number: (212) 794-4027

Website: GreenHills Ventures

New York, USA | Madrid, Spain | Singapore | Dublin, Ireland | Luxembourg

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Ashley Parot

Contact Person: Ashley Parot

Email: Send Email

Phone: (212) 794-4027

Address:420 Lexington Avenue, 3rd Floor, Office 300

City: New York

State: NY 10017

Country: United States

Website: http://www.greenhillsventures.com/