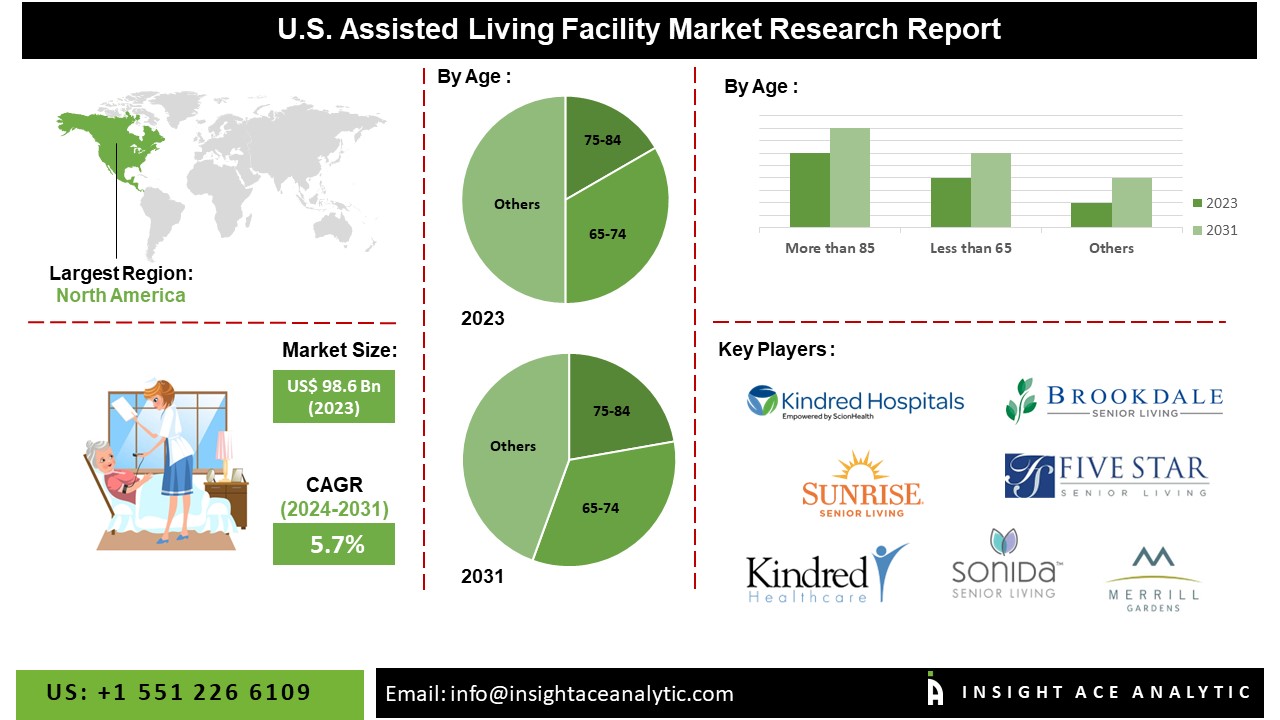

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “U.S. Assisted Living Facility Market Size, Share & Trends Analysis Report By Age (More than 85, 75-84, 65-74, Less than 65)- Market Outlook And Industry Analysis 2031″

The U.S. Assisted Living Facility Market is valued at US$ 98.6 Bn in 2023, and it is expected to reach US$ 151.4 Bn by 2031, with a CAGR of 5.7% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC : https://www.insightaceanalytic.com/request-sample/2616

The U.S. Assisted Living Facility (ALF) market involves a vital segment of the healthcare and senior living industries, providing essential services to older adults who require assistance with daily activities while maintaining a degree of independence. Assisted living facilities offer a combination of housing, personal care, and healthcare services tailored to the needs of seniors, making them an attractive option for those who do not need the intensive medical care provided in nursing homes. These facilities serve various functions, including offering meals, housekeeping, transportation, and support with personal care tasks such as bathing, dressing, and medication management.

The significance of ALFs is underscored by the growing geriatric population in the United States, which is projected to increase substantially in the coming decades. Assisted living facilities provide a cost-effective alternative to nursing homes, allowing seniors to age in place while receiving the necessary support. ALFs vary widely in terms of size, services, and amenities, including independent living communities for largely independent seniors, personal care homes that offer a homelike environment, and memory care facilities designed for residents with Alzheimer’s disease or other forms of dementia.

According to the American Health Care Association (AHCA) and the National Center for Assisted Living (NCAL), the United States had over 28,900 assisted living homes and nearly 1 million licensed beds in 2020. The average assisted living home has 33 licensed beds. There are around 811,500 inhabitants nationwide (71% women, 29% males), with more than half of them aged 85 and over.

List of Prominent Players in the U.S. Assisted Living Facility Market:

- Abri Health Care

- Aegis Living Shadowridge

- Allegro

- Artis Senior Living

- Atria Senior Living, Inc.

- Avalon Health Care Group

- Belmont Village, L.P.

- Benchmark Senior Living

- Bonaventure Senior Living

- Brandywine Senior Living

- Brightview Senior Living

- Brookdale Senior Living Inc.

- Capital Senior Living

- CareOne LLC

- Carillon Assisted Living

- Extendicare

- Felicita Vida

- Five Star Senior Living

- Frontier Senior Living

- Gardant Management Solutions

- genesis healthcare

- Integral Senior Living (ISL)

- Kindred Healthcare, LLC

- Kisco Senior Living

- La Marea Senior Living

- Leisure Care, LLC

- Life Care Centers of America Inc.

- Merrill Gardens

- Morningstar Senior Living

- National HealthCare Corporation

- New Perspective Senior Living

- Pacifica Senior Living

- Pegasus Senior Living

- ProMedica Senior Living

- Sagora Senior Living

- Senior Lifestyle

- Silverado Senior Living

- Sonida Senior Living

- StoryPoint Group

- Sunrise Senior Living, LLC

- The Ensign Group, Inc.

- The Evangelical Lutheran Good Samaritan Society

- The Holiday Retirement

- The Montera

- White Sands La Jolla

- Others

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2024-02

U.S. Assisted Living Facility Market Report Scope:

|

Report Attribute |

Specifications |

|

Market Size Value In 2023 |

USD 98.6 Bn |

|

Market Size Value In 2031 |

USD 151.4 Bn |

|

Growth rate CAGR |

CAGR of 5.7% from 2024 to 2031 |

|

Quantitative units |

Representation of revenue in US$ Bn, and CAGR from 2024 to 2031 |

|

Historic Year |

2019 to 2023 |

|

Forecast Year |

2024-2031 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

By Age |

Market Dynamics:

Drivers-

The U.S. Assisted Living Facility market is driven by several key factors that contribute to its growth and demand. The aging population, with more individuals reaching an age where they require assistance with daily activities, is one of the most significant drivers. Many seniors prefer to maintain their independence while receiving support for daily tasks, and assisted living facilities provide a solution that allows older adults to live in a community setting with access to necessary care, promoting a sense of autonomy and well-being. Additionally, increased healthcare spending in the U.S. has led to greater investment in senior care services, reflecting a broader societal commitment to improving the quality of life for older adults. The rising incidence of chronic diseases such as diabetes, obesity, and heart conditions among the elderly population also necessitates additional care and support, further fueling the demand for assisted living facilities.

Challenges:

The assisted living sector faces critical challenges, including workforce shortages, financial pressures, and regulatory compliance. Many facilities struggle to hire qualified staff, leading to higher operational costs due to increased wages and overtime. Rising operational expenses, driven by inflation and wage increases, have caused some facilities to operate at a loss, affecting their ability to maintain quality care and invest in improvements. Additionally, navigating complex state regulations requires significant resources, posing challenges for smaller or independent facilities.

Empower Your Decision-Making with 180 Pages Full Report @ https://www.insightaceanalytic.com/enquiry-before-buying/2616

Recent Developments:

- In May 2024, Belmont Village Senior Living and Greystar Real Estate Partners, LLC are developing Belmont Village Rancho Santa Fe, a luxury senior housing community in the gated Lakes of Rancho Santa Fe master-planned community. The fully entitled project, years in the making, is set to break ground before year-end.

- In Dec 2021, Five Star Senior Living Inc. announced a collaboration with Compass Community Living, a division of Compass Group. Compass will assume management of dining services at all Five Star senior living communities, enhancing Five Star’s commitment to delivering exceptional, customer-focused experiences.

Segmentation of U.S. Assisted Living Facility Market-

By Age:

- More than 85

- 75-84

- 65-74

- Less than 65

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/1712

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/