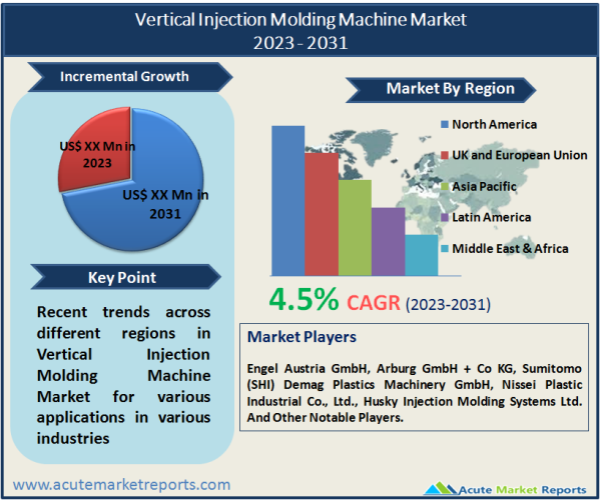

The market for vertical injection molding machines is anticipated to grow at a CAGR of 4.5% during the forecast period of 2023 and 2032. This market is predominately concerned with the production and sale of vertical injection molding machines, which are used to manufacture plastic products by injecting molten plastic into a mould cavity. The increasing demand for plastic products in various end-use industries, such as automotive, consumer goods, electronics, and healthcare, is one of the main factors driving the growth of the vertical injection molding machine market. The ability of these machines to produce complex and precise plastic components efficiently has made them extremely desirable in these industries. In addition, technological advances in vertical injection molding machines have contributed to the expansion of the market. Manufacturers are continually striving to improve the effectiveness, speed, and accuracy of these devices, resulting in increased output and decreased production costs. Integration of automation and robotics technologies has also significantly contributed to the refining of the injection molding process. In addition, the market is experiencing a transition towards electric vertical injection molding machines, as opposed to conventional hydraulic machines. Electric devices provide benefits such as increased energy efficiency, decreased maintenance needs, and enhanced process control. This transition is a result of the increasing emphasis on sustainability and environmental concerns, as electric devices have a smaller carbon footprint than their hydraulic counterparts. Market expansion is likely to be influenced by factors such as increasing industrial automation, rising demand for lightweight and durable plastic products, and the expansion of end-use industries in developing economies.

The demand for plastic products in industries such as automotive, consumer goods, electronics, and healthcare is driving the market for vertical injection molding machines. Due to their adaptability, durability, and affordability, plastics have become an indispensable material in these industries. According to the International Organisation of Motor Vehicle Manufacturers (OICA), the global production of motor vehicles exceeded 95 million units in 2020, with a substantial portion of these vehicles containing plastic components. The automotive industry significantly relies on injection molding machines for the production of interior and exterior plastic components such as dashboards, bumpers, and door panels. Similarly, the consumer goods industry, which includes packaging, appliances, and furniture, relies significantly on plastic products. The need to efficiently manufacture plastic bottles, containers, home appliances, and other consumer products drives the demand for injection molding machines.

Vertical injection molding machine innovations have played a crucial role in propelling market expansion. To satisfy the growing demand for high-quality plastic products, manufacturers are continuously enhancing machine efficiency, speed, and accuracy. Injection molding machines are substantially more productive and efficient due to the incorporation of automation and robotics technologies. Automated systems can perform duties such as mold replacement, material feeding, and part ejection, minimizing the need for manual intervention and production downtime. In addition, advancements in control systems and sensors have improved the injection molding process’ precision and consistency. Monitoring and controlling machine parameters in real time enables manufacturers to maintain product quality and reduce material waste. Due to their numerous advantages, hydraulic vertical injection molding machines are being replaced by electric machines on the market. The energy efficacy of electric machines is superior to that of hydraulic machines. During operation, they consume less energy, resulting in cost savings and reduced environmental impact. Additionally, electric devices offer faster cycle times, allowing for increased production output and reduced lead times. In addition, electric machines require less maintenance than hydraulic machines because they do not require hydraulic lubricant and have fewer moving parts. This reduces downtime and increases the overall dependability of the machine. Several manufacturers have already adopted electric vertical injection molding machines, and this shift is anticipated to continue as the manufacturing sector places a greater emphasis on sustainability and energy efficiency.

Browse for the report at: https://www.acutemarketreports.com/report/vertical-injection-molding-machin-market

The steep initial investment and operating costs associated with vertical injection molding machines represent a significant market constraint. The purchase and installation of a vertical injection molding machine, along with molds and automation systems, can necessitate a substantial financial outlay. In addition, skilled labor and maintenance expenses contribute to the operating expenses. Depending on its size, capacity, and technological features, the price of a vertical injection molding machine may vary. A high-end machine with sophisticated automation capabilities can cost tens or even hundreds of thousands of dollars. In addition, the cost of molds, which must be custom-made for each product, can be substantial. Expenses such as electricity, basic materials, maintenance, and labor are included in operating costs. To power their motors, heating elements, and hydraulic or electrical systems, injection molding devices require a constant supply of electricity. Electricity costs can be substantial, particularly for devices with high production volumes. Effective operation and maintenance of injection molding machines require skilled labor. Expertise is necessary for machine setup, mold adjustments, troubleshooting, and quality control, which increases labor costs. For the machinery to operate effectively and to prevent breakdowns, which can incur additional costs, routine maintenance, and servicing are required. Overall, the high initial investment and ongoing operational costs pose a significant barrier for businesses contemplating entry into the vertical injection molding machine market, limiting their potential adoption and growth.

The market for vertical injection molding machines can be segmented by machine type into hydraulic, electric, and hybrid machines. Among these kinds, electric machines are anticipated to experience the highest CAGR from 2023 to 2031, and they generated the most revenue in 2022. Due to their numerous advantages over hydraulic and hybrid machines, electric vertical injection molding machines are acquiring popularity. In the long run, electric machines are more cost-effective due to their greater energy efficiency, quicker cycle times, and reduced maintenance needs. The emphasis on sustainability and energy conservation has increased the adoption of electric machines across a variety of industries, thereby propelling their market expansion. Moreover, electric machines provide precise injection process control, ensuring consistent product quality and minimizing material waste. This characteristic makes them ideal for producing high-precision plastic components used in industries such as the automotive, electronics, and healthcare sectors. Consequently, the demand for electric vertical injection molding machines is anticipated to increase, contributing to their maximum CAGR from 2023 to 2031. In contrast, hydraulic devices have been traditionally utilized in the injection molding industry and continue to hold a substantial market share. These devices have a high clamping force and are capable of working with a variety of materials. However, compared to electric devices, their lower energy efficiency and higher maintenance requirements limit their growth potential. Combining hydraulic and electric technologies, hybrid machines strike a balance between energy efficiency and force. They offer the benefits of both varieties, including a strong clamping force and precise control. Applications requiring a combination of power and accuracy are suited to hybrid machinery.

Download Free Sample Copy From https://www.acutemarketreports.com/request-free-sample/139673

The market segment for automation-grade vertical injection molding machines includes automatic and semi-automatic machines. As measured by CAGR from 2023 to 2031 and revenue in 2022, automatic machines are anticipated to dominate the market. Automatic injection molding machines with a vertical axis are equipped with sophisticated features and capabilities that boost productivity and efficiency. These machines feature automated systems for duties such as mold replacement, material feeding, part ejection, and quality control. By minimizing the need for manual intervention, automatic machines allow for continuous and uninterrupted production, resulting in increased output and decreased downtime. The increasing demand for increased production efficiency and the requirement for consistent quality control are propelling forces behind the adoption of automatic machines. In order to fulfill their production goals, industries such as automotive, electronics, and packaging rely heavily on automatic machines for the mass production of precise plastic components. The ability to incorporate automation technologies, such as robotics and artificial intelligence, augments the capabilities of automatic machines, thereby increasing their market demand. Automatic machines are anticipated to dominate the market in terms of revenue generation due to their higher initial cost compared to semi-automatic machines. For many manufacturers, the sophisticated automation features and increased productivity offered by automatic machines justify their higher prices. The higher revenue generated by automatic machines can be attributed to their capacity to meet large-scale production demands and maintain quality consistency. Semi-automatic machines, on the other hand, necessitate manual intervention at different phases of injection molding. Operators perform tasks such as loading and unloading molds, supplying materials, and removing parts. Typically, these machines are preferred for applications with comparatively low production volumes or where a greater degree of manual control is desired. In spite of the continued use of semi-automatic machines in certain industries, the demand for automatic machines is anticipated to outpace that of semi-automatic machines due to the need for increased efficiency and productivity. The growth potential of automatic machines is fueled by the advantages they provide in terms of increased output, decreased downtime, and enhanced quality control.

Due to a number of factors, Asia Pacific dominated the vertical injection molding machine market in terms of revenue in 2022 and is anticipated to exhibit the highest CAGR from 2023 to 2031. The region is home to important manufacturing hubs, such as China, Japan, South Korea, and India, which have a substantial demand for plastic products across a variety of industries. Asia-Pacific’s automotive industry is notably robust, driving demand for injection molding machines to manufacture plastic vehicle components. In addition, the region’s rapid industrialization, urbanization, and rising consumer spending have contributed to the expansion of industries such as consumer products, electronics, and healthcare, thereby boosting the demand for vertical injection molding machines. China, in particular, plays a pivotal role in the Asia-Pacific market, accounting for a substantial portion of the revenue. Strong manufacturing capabilities, a large consumer base, and government policies that encourage growth have made the country a major player in the vertical injection molding machine market. North America and Europe are also important market regions, but their development rates are relatively slower due to market saturation and mature industries. Demand for high-quality plastic products in industries such as automotive, aerospace, and medical continues to make these regions significant vertical injection molding machine markets. Emerging economies in Latin America and the Middle East & Africa are contributing to the market expansion of vertical injection molding machines. These regions are experiencing a rise in industrialization, infrastructure growth, and the demand for consumer commodities and automobiles.

The market for vertical injection molding machines is highly competitive, with numerous key players vying for market share and global expansion. These market competitors employ a variety of strategies, including product development, mergers and acquisitions, partnerships, and geographic expansion, to remain competitive. Engel Austria GmbH, Arburg GmbH + Co KG, Sumitomo (SHI) Demag Plastics Machinery GmbH, Nissei Plastic Industrial Co., Ltd., and Husky Injection Moulding Systems Ltd. are among the market leaders for vertical injection molding machines. Through technological advancements, extensive product lines, and a loyal customer base, these businesses have established themselves as industry leaders. Continuous product development is one of the main strategies employed by these businesses. To meet the evolving demands of end-use industries, they concentrate on improving the features, performance, and efficiency of their vertical injection molding machines. By investing in R&D, these competitors aim to provide innovative solutions that improve productivity, energy efficiency, and precision. In order to expand their product offerings, consumer base, and geographic reach, businesses seek opportunities to acquire or merge with other competitors. These strategic moves help them obtain a competitive advantage and strengthen their position in the market. Key competitors in the vertical injection molding machine market also employ partnerships and collaborations as crucial business tactics. By forming strategic alliances with other businesses, such as material suppliers or technology providers, they are able to offer customers comprehensive solutions and enhance their overall value proposition. Collaborations also facilitate knowledge sharing and innovation, allowing businesses to remain on the cutting edge of technological advances.

Visit For Business News: https://www.mobilecomputingtoday.co.uk/business/

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com