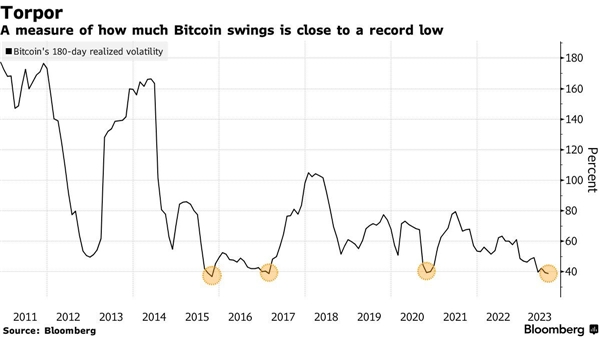

While the crypto market is famous for its wild swings, over the past 3 years, volatility’s been steadily dropping. Until this August, Bitcoin hit an all-time low in volatility.

According to Bloomberg data, Bitcoin’s 30-day volatility dropped to nearly 20 basis points after a significant decline, a level it has been under for only 2% of the past decade. It’s rarer than a unicorn sighting to see it dip below 20 basis points and then bounce back above. But here’s the silver lining: in those seven instances where it bounced back, Bitcoin averaged a 16% increase in the following month.

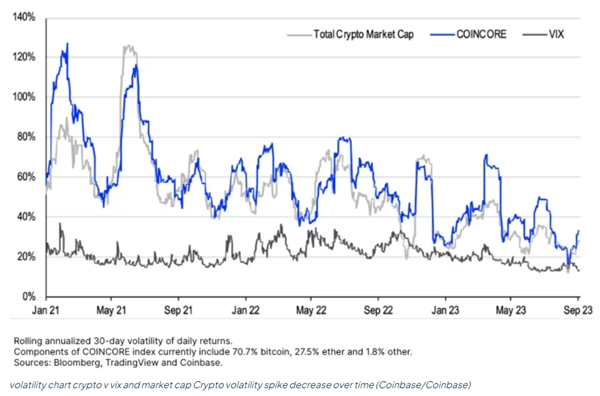

Examining Coincore’s volatility index for the crypto market, it’s been shrinking since 2021 and hit a new low in August.

Crypto investments have been popular partly because of their high volatility, offering opportunities to profit from price gaps in the differing opinions of buyers and sellers. But with reduced market volatility, investor enthusiasm for taking on risk and trading has waned, leading to a slump in activity.

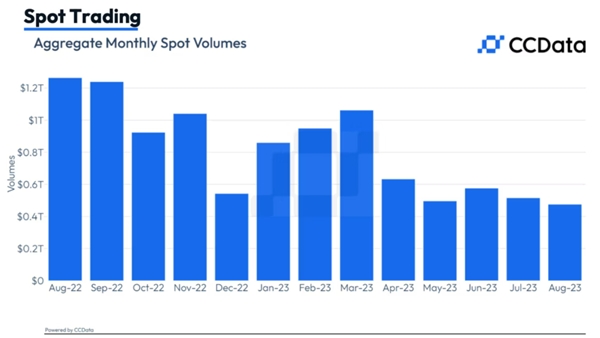

After reaching multi-year lows in May for spot crypto trading volumes, August hit another low point. According to crypto research firm CCData, CEX spot trading volumes in August were just 475 billion dollars, down nearly 8%, marking the lowest since March 2019. On August 26th, daily trading volume fell below 6 billion dollars, the lowest since February 2019.

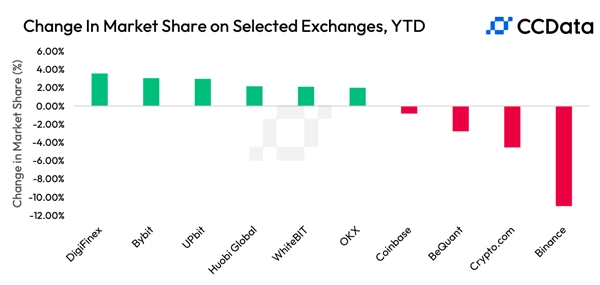

On one hand, spot trading volumes hit a four-year low, and volatility reached all-time lows. On the other hand, as FTX’s meltdown sparked FUD (fear, uncertainty, doubt), and global regulatory crackdowns continued, the exchange market landscape is going through a major reshuffle, intensifying the competition for existing users.

CCData analyst spoint out that despite Binance’s trading volume reaching 183 billion dollars, its market share has been on a six-month downward trend, plummeting to 38% in August, the lowest since August 2022.

At the same time, recent incidents involving BKEX and JPEX, along with BTCEX announcing its closure in July, and CoinEx suffering losses of over 70 million dollars in a hack, have further fueled the exchange industry’s transformation.

Against this backdrop, some second-tier exchanges with solid security measures, regulatory compliance, and substantial asset reserves have rapidly risen in the derivatives market, gradually eroding the market share of other platforms. Derivative trading allows for the amplification of volatility through leverage and supports both long and short positions. Therefore, while the spot trading volume has shrunk significantly, the derivatives market, although experiencing a concurrent downturn, still boasts substantial trading volumes. According to CCData, spot trading volume on centralized exchanges in July was 515 billion dollars, while the derivative trading volume during the same period was 1.85 trillion dollars.

On August 1st, crypto derivatives exchange WEEX announced a successful funding round, valuing the company at 100 million dollars. South Korean digital marketing giant FSN, a publicly traded company, is set to lead the investment. The funds raised will primarily fuel WEEX’s global expansion in the cryptocurrency market while enhancing user trading security.

Meanwhile, WEEX exchange has been actively pursuing market capture through various means, including listings, global expansion, and user engagement. Regarding listings, since the start of 2023, WEEX has added nearly 100 spot trading pairs and over 80 futures trading pairs, catering to users across different segments, especially popular projects. In terms of global expansion, WEEX App now covers most global markets, making it one of the most widely available exchanges alongside platforms like Bybit, OKX, Bitget, and Kucoin. Concerning user engagement, WEEX has launched a series of activities clearly aimed at attracting and retaining users.

Zero barriers! Deposit to unlock 5,000 USDT

From September 19th to 25th, new registered users complete KYC automatically participate and receive futures trial funds as a bonus for any USDT deposit amount, with a maximum unlock of $5,000.

“Ultra-Low Trading Fee” program, Enjoy the Lowest Fees Across the Board!

From September 7th to October 6th, all U-based futures trading pairs except BTC/USDT and ETH/USDT will have their fees halved. Maker fees will be set at 0.01%, and Taker fees at 0.03%. Research shows that after the launch of the WEEX “Ultra-Low Trading Fee” program, both Maker and Taker fees are among the industry’s lowest, making it one of the most competitive trading platforms.

Your VIP is My VIP – Trade to Receive 1,200 U and a WEEX Merchandise!

During the activity (Aug 21, 2023 – Sep 22, 2023), become a WEEX Exchange VIP and meet futures trading goals to win up to 1,200 USDT in futures trial funds and exclusive WEEX merchandise.

WEEX Exchange: A rising star in derivatives, offering futures and spot trading. With a million+ users and daily volumes exceeding $1.5 billion, top 10 on CoinMarketCap and top 20 on CoinGecko. WEEX is licensed in the US, Canada, and Saint Vincent and the Grenadines, pursuing more licenses globally. Security of user funds is the top priority, WEEX has a 1,000 BTC Investor Protection Fund and transparent hot wallet addresses for peace of mind.

In terms of security and risk management, WEEX utilizes an intelligent risk control system combined with a dual-layer manual risk control approach. WEEX’s servers are deployed and backed up in multiple global locations, boasting a comprehensive server security strategy to safeguard platform data and user information. WEEX employs distributed wallet management, ensuring rapid fund allocation and multi-wallet management verification to ensure fund security. With a dedicated risk control team, WEEX prevents malicious trading activities, ensuring fair and secure trading while safeguarding the rights and interests of ordinary users. Since its inception, WEEX has never experienced any security breaches or attacks.

About WEEX:

As a futures-friendly exchange, WEEX stands out for its deep liquidity, ranking among the top five in global exchange average liquidity according to CoinMarketCap. WEEX leads the industry in order book depth and spread, achieving millisecond-level matching, zero slippage, and zero spread, minimizing user trading costs and liquidity risks. Furthermore, WEEX offers copy trading, allowing users to replicate the strategies of professional traders. This not only reduces the barrier to entry for newcomers in futures trading but also improves trading success rates, making it widely popular among contract users and professional traders alike.

2022 crypto winter, WEEX surged with 3,000% growth in contract business. In 2023, monthly trading users rose 100%, peaking at 1,000 new registrations and 500 first deposits daily, breaking DAU records.

Market shifts reshape exchanges; WEEX, a dark horse, excels with secure, licensed operations, superior trading, and reliable service, gaining users’ trust in the evolving exchange landscape.

Media Contact

Company Name: WEEX Exchange

Email: Send Email

Country: Singapore

Website: https://www.weex.com